London School of Business & Finance is a part of the Global University Systems group of companies (the GUS Group). The information you provide on this form will be processed in accordance with London School of Business & Finance's Privacy Policy. London School of Business & Finance will use the details provided by you to get in touch with you about your enquiry.

The Master in Finance and Investments is the ideal programme for those looking to learn the latest financial concepts, business philosophies, and leadership techniques. There are four specialisation pathways available, allowing you to direct the programme to suit your career objectives. You will graduate possessing top-level leadership and management attributes, making you a highly sought-after candidate in the global finance and investment sector.

Learning Outcomes

Graduates of the Master in Finance and Investments will gain career-ready skills in:

- Interpreting business and international financial statements

- Using quantitative methods, in relation to financial markets

- Using finance and investment decisions to achieve a competitive advantage

- Evaluating corporate finance structures and managing financial risk

- Maximising corporate value while reducing corporate risks

-

You will study your programme with London School of Business & Finance. Your programme modules and learning content are delivered via the Canvas study platform, and feature the following resources:

- Professionally produced video lectures created by leading business practitioners

- A designated tutor who will provide support and feedback throughout your programme

- Case studies and discussion questions to enhance your understanding of theory in context

- Downloadable e-books and free library resources to aid your assignment writing and research

- Access to online forums where you can share and discuss new concepts with fellow students and professionals from around the world

- UK undergraduate degree or equivalent – any subject area

- English levels 5.5 IELTS (5.5 in all bands) or equivalent*

- Relevant work experience is an asset, but no work experience is required

The Master in Finance and Investments degree syllabus considers today's challenging business environment and the financial expertise you need to excel within it. The 3 core and 3 elective modules will equip you with a deep understanding of investments and financial statements, corporate finance, financial econometrics and advanced asset pricing. The final research project will give you hands-on experience, ensuring your competence in a financial decision-making environment. Follow this link to see the full programme syllabus.

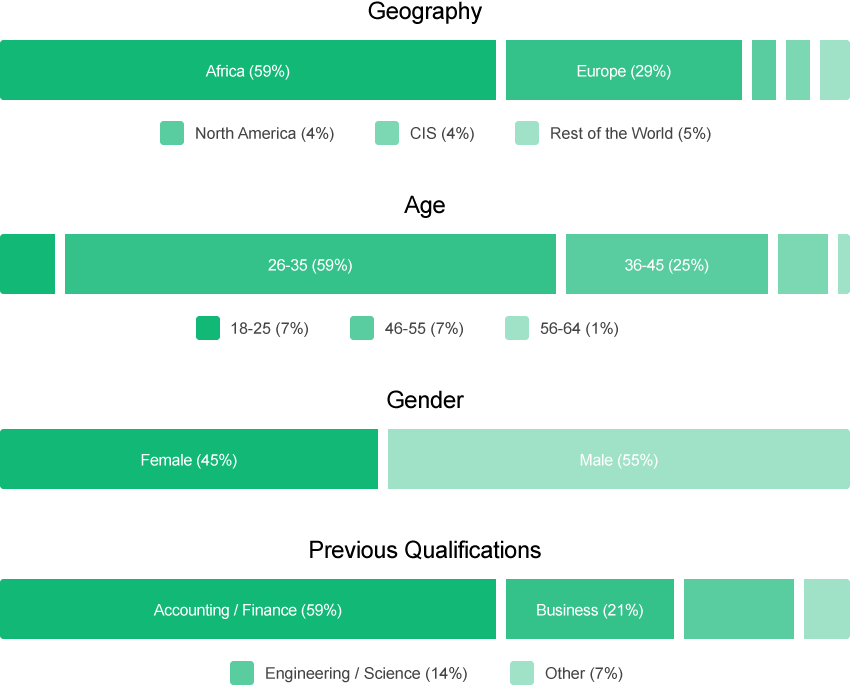

Information is based on the class of 2015-2016

Ready to apply?London School of Business & Finance is a part of the Global University Systems group of companies (the GUS Group). The information you provide on this form will be processed in accordance with London School of Business & Finance's Privacy Policy. London School of Business & Finance will use the details provided by you to get in touch with you about your enquiry.Apply nowReady to Apply?Degrees, professional qualifications, and short courses delivered onlineChoose Exam Dates and Additional MaterialsAdd Billing DetailsSelect Payment Method#StaySafe #StayHome — Click here to continue your learning journey even while you are at home with Edology’s Online Undergraduate, Masters & Diploma Courses.