Start Dates

1st and 15th of every month

Duration

3 months

Fees

£550

Award

London School of Business & Finance

Learn the corporate finance skills needed to show employers that you've got what it takes to excel in the workplace.

This certificate course will teach you about the decisions that underpin the application of corporate finance procedures, and how to use cash management models to evaluate common working capital policies. You will also examine how to apply discounted cash flow methods to analyse investment decisions, learn about the concepts of risk and return, and understand how to calculate the cost of capital.

Learning Outcomes

Graduates of this certificate programme will possess career-ready skills in:

- Financial management and corporate finance decision models

- Working capital policies and their application to capital decision making

- Capital structure theories and their application to financial decision making

- Traditional and discounted cash flow investment decision tools and their application to investment decision making

-

Your programme modules and learning content are delivered via the Canvas study platform, and feature the following resources:

- Professionally produced video lectures created by leading business practitioners

- A designated tutor who will provide support and feedback throughout your programme

- Case studies and discussion questions to enhance your understanding of theory in context

- Downloadable e-books and free library resources to aid your assignment writing and research

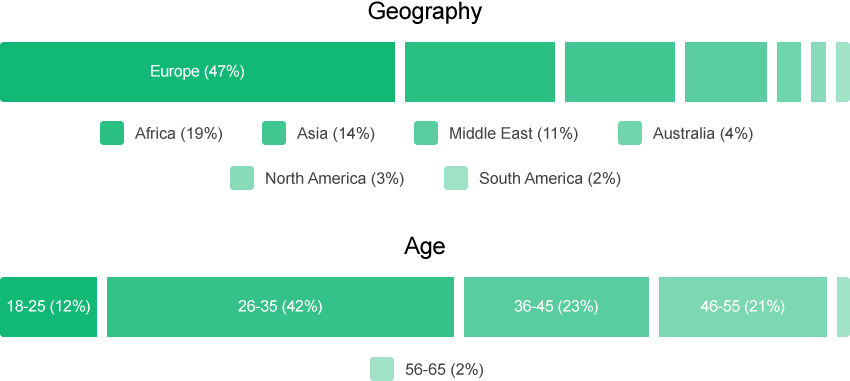

- Access to online forums where you can share and discuss new concepts with fellow students and professionals from around the world

- A good level of English language ability is recommended

- Relevant work experience is an asset, but no work experience is required

This certificate programme will cover the following topics:

- Building blocks of corporate finance - financial management and corporate finance decision models

- Investment Decisions - traditional and discounted cash flow investment decision tools and their application to investment decision making

- Financing Decisions I - capital structure theories and their application to financial decision making

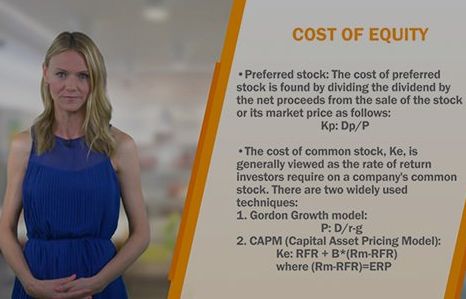

- Financing Decisions II - risk and return trade-off, the cost of equity, the cost of debt and the weighted average cost of capital (WACC)

- Working Capital Decisions - working capital policies, formulas and cash flow management models, and their application to capital decision making

You will be formally assessed which will consist of a multiple choice quiz. Completing this assignment to a satisfactory standard is a mandatory requirement.

Based on all online student classes of 2016

Choose Exam Dates and Additional MaterialsAdd Billing DetailsSelect Payment Method