What is the Introduction to Finance course about?

On this certificate programme, students learn to use financial tools for efficient business operations, and gain experience in generating and assessing the amounts, timing, and uncertainty of cash flows. While instilling these basic concepts in financial reporting, the course also explores the role of agency theory in corporate governance.

What are the advantages of studying Introduction to Finance online?

After completing this programme, students will be equipped with the following skills:

- Problem-solving abilities in finance

- Applying basic financial analytical skills to make efficient decisions

- Managerial and leadership qualities

- Determining risk-adjusted profits or discount rates.

Learning Outcomes

Graduates of this certificate programme will possess career-ready skills in:

- Valuation, portfolio theory, and foreign exchange markets

- The use of NPV and IRR future values, present value, perpetuities, and annuities

- Financial markets and institutions, including the stock market and financial intermediaries

- The role of the financial manager, cash flow versus profit, agency theory, and corporate governance

-

Your programme modules and learning content are delivered via the Canvas study platform, and feature the following resources:

- Professionally produced video lectures created by leading business practitioners

- A designated tutor who will provide support and feedback throughout your programme

- Case studies and discussion questions to enhance your understanding of theory in context

- Downloadable e-books and free library resources to aid your assignment writing and research

- Access to online forums where you can share and discuss new concepts with fellow students and professionals from around the world

- A good level of English language ability is recommended

- Relevant work experience is an asset, but no work experience is required

The course seeks to develop problem-solving skills in finance which enable you to apply intuition and basic financial analytical skills to decision making, through an examination of the following subject areas:

- Introduction to finance – the role of the financial manager, cash flow versus profit, agency theory, and corporate governance

- Financial Markets & Institutions – the stock market, other financial markets, financial intermediaries, financial institutions

- Project and Investment Decisions – the use of NPV and IRR future values, present value, perpetuities, and annuities

- Valuation – bond valuation, share valuation, and accounting versus finance approaches

- Portfolio Theory – the Markowitz Mean, and the variance approach

- Foreign Exchange Markets – PPT and IPT, forward, future, option and swap markets

You will be formally assessed which will consist of a multiple choice quiz. Completing this assignment to a satisfactory standard is a mandatory requirement.

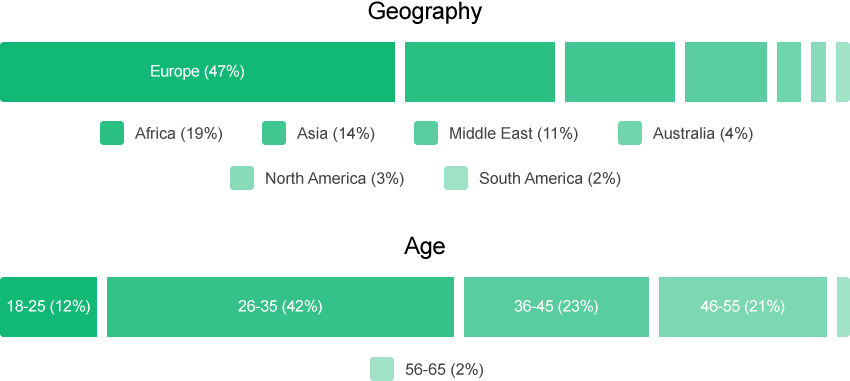

Based on all online student classes of 2016

This Certificate in Introduction to Finance is designed for students who want to further their understanding of financial accounting, enhance their CV, and improve their job prospects in the field of finance.

The Certificate in Introduction to Finance course provides essential financial management techniques. Upon completing this programme, graduates will have career-oriented skills in the following areas:

- Financial markets and institutions – Discover the methods that are involved in buying and selling shares in the form of stocks, bonds, and other securities. The programme provides an overview of how financial institutions conduct transactions such as deposits, loans, investments, and currency exchange. Students have the opportunity to explore the function of financial intermediaries during fund exchange processes.

- Project and investment decisions – Develop the skills to measure investment performance, while gaining an understanding of the relationship between the two metrics, return on investment (ROI) and internal rate of return (IRR). Students will form an understanding of discount rates and net present value (NPV), as well as annuity and perpetuity.

- Valuation – Bond and stock valuation allow investors to estimate predictable cash flow and rate of return. Students will develop the technique of determining the theoretical fair value of a bond, and use bond valuation in practice.

- Portfolio theory – Covering the basics of Markowitz’s Modern portfolio theory, this course introduces how a set of returns can be maximised for a given level of risks (based on mean-variance), and how mean-variance analysis allows investors to choose which financial instruments they want to invest in. Students also analyse the profit amount that can be gained at a given level of risk or return.

- Foreign exchange markets –During the course, students will learn to determine the exchange rate for global currencies, and become familiar with the application of personal performance targets (PPT) and incremental performance targets (IPT).

Choose Exam Dates and Additional MaterialsAdd Billing DetailsSelect Payment Method